6 March 2020

The South Australian Government has passed into law significant amendments to the land tax measures. These will come into effect from 1st July 2020 (and relate to land held as at 30 June 2020). Moving forward this will impact how land tax is calculated and while you may currently pay little or no land tax that could change with the introduction of these new laws. Though, it is not all bad news as some taxpayers may find themselves with less land tax to pay as the top rate has reduced from 3.7% to 2.4%.

Furthermore, certain groups of land holders (i.e. land held in a trust) will have additional compliance obligations, which require lodging reports with Revenue SA by 31st July 2020.

Key Changes

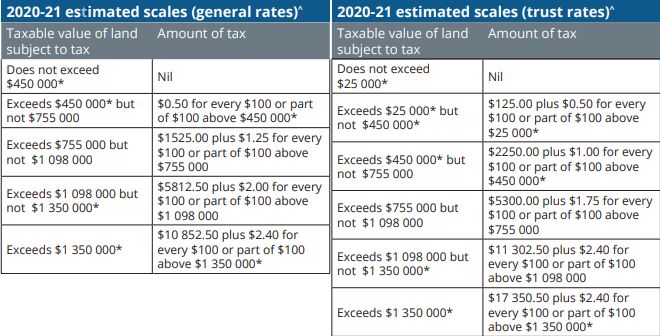

- Introduction of a surcharge on land held in trusts. There will be two land tax rates operating concurrently:

- Trust rates – additional 0.50% surcharge (site value exceeding $25,000)

- General rates – other taxpayers including some discretionary trusts and excluded trusts – new tax-free threshold of $450,000

^Estimated thresholds reflect expected site value growth as at the 2019/2020 Budget

*Thresholds not subject to change (value fixed by Legislation in relevant year)

-

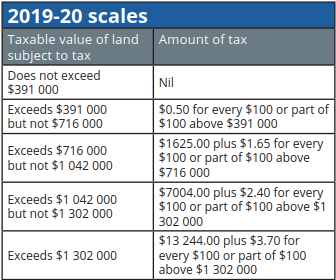

- Current rate structures for 2019/2020

-

- Top land tax rate reduced from 3.7% to 2.4%

- A shift to aggregation based on an owner’s interest in every piece of land, rather than only aggregating properties held in the same ownership structure;

- Related companies will now be grouped and land treated as if owned by a single corporation;

- New reporting requirements for trustees including notifying the Commissioner for:

- All existing holdings

- All new acquisitions and disposals of land

- Any change in the category of the trust

- Change in beneficial interest in fixed and unit trusts

- Completion of administration estate

- Ex gratia relief provided to eligible individuals

Treatment of land held in various structures

There is no disputing these land tax changes will impact all land holders. While most taxpayers will not be affected greatly; it will be those who hold multiple land holdings in different structures (jointly held, trusts and companies) that will be affected the most. The Government aims to “look-through” these structures, where in the past, the land holdings were taxed separately where owned in multiple entities.

For land held in Trusts, the rules will differ for discretionary and unit trusts and where decision making is required which will ultimately impact the end result:

-

-

- Unit Trust – Trustee of Unit Trusts will need to engage with their unit holders and decide whether to do nothing and be subject to the higher trust surcharge rates or whether to notify the Commissioner and be subject to the general rates where all unit holders will be taxed in proportion to their respective interest.

- Discretionary Trusts – similarly, land held in trusts will be subject to the higher trust rates unless they able to nominate a beneficiary as the “owner” for land tax purposes, where they will be assessed at the general rates.

-

If you are a Trustee holding land in a trust, and able to nominate a beneficiary, the Government has extended the deadline to 30 June 2021. This is a once-off opportunity for land held by the trustee before 16th October 2019. The beneficiary will receive a land tax assessment, but will receive a credit for any tax paid by the trust. There are additional conditions and considerations to this nomination, however this is an important issue for review to assist in managing your land tax obligations.

Ex Gratia Relief

Taxpayers who will be worse off with the new land tax measures may have access to concessions to alleviate the increase. To be eligible, the increase in your land tax bill must be above $2,500 when compared to the old rates for 2019/2020. Although the Government has set up a compensation scheme for $25m, this is a temporary relief which will be available for up to three years. Furthermore, the amount of funds the Government has set aside for this means that eligible taxpayers may miss out once those funds have been exhausted.

Concluding Remarks

The new land tax changes to come into force 1st July 2020 are lengthy and complicated. The Government have introduced new aggregation rules shifting away from aggregating properties held within the same ownership structure to aggregating based on an owner’s interest and will group related companies. There will be two land tax rates, the higher of which most trusts will be subject to unless they nominate a beneficiary. Furthermore, trustees will have additional reporting obligations. Eligible taxpayers who are hit with a higher land tax payable than they are used to previously, may have access to concessions to help alleviate the pain.

The new laws provide an opportunity for landholders to review their structures and to consider the impact these changes will have. We encourage all land owners to fully discuss their circumstances with their accountant to be able to make the most tax-effective choices.

Disclaimer

All information provided in this article is of a general nature only and is not personal financial or investment advice. Also, changes in legislation may occur frequently.

We recommend that our formal advice be obtained before acting on the basis of this information