14 August 2020

JobKeeper 1.0 Reminder

For those currently registered in the JobKeeper program

For the month of August 2020 please be mindful that there are 3 fortnights for the purposes of the JobKeeper program. What does this mean?

For the month of August, eligible employees are required to each be paid at least $1,500 in each of the 3 fortnights that fall in the month of August (a total of at least $4,500 Gross Wages).

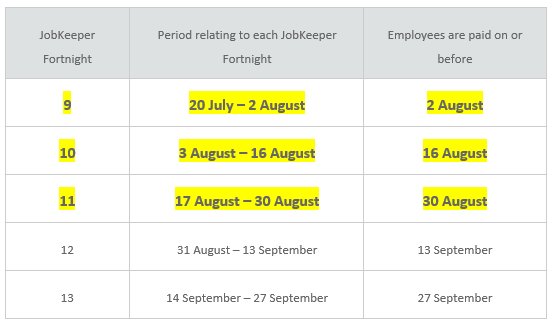

Please see below the JobKeeper fortnights affecting the month of August through to the end of September under the original JobKeeper program.

JobKeeper fortnights (up until 27 September)

For those not currently registered in the JobKeeper program

To claim JobKeeper payments for the August JobKeeper fortnights, you must enrol for JobKeeper and identify your eligible employees by 31 August 2020.

If you require assistance assessing your eligibility to these payments and and/or your business has become eligible for the month of August, please contact this office.

JobKeeper 2.0 Update

There are many questions regarding the ins and outs of JobKeeper 2.0. We are awaiting further commentary from the Australian Taxation Office (“ATO”) with parliament due to next meet on the 24 August 2020 to discuss this further. Hopefully we will see further information in the coming weeks.

Further changes were announced on 7 August 2020 to adjust the reference date for an employee’s eligibility and make it easier for organisations to access JobKeeper payments in light of the further restrictions in Victoria. From 3 August 2020, the relevant date for employment will move from 1 March to 1 July 2020.

Some of the implications of these changes are;

- If you have had new staff which started after 1st March 2020 but prior 1st July 2020, who were ineligible for the original JobKeeper 1.0, may now be eligible for JobKeeper;

- If you have long-term casuals whose 12 month anniversary of employment fell between 1st March 2020 and 1st July 2020 may now be eligible for JobKeeper;

The ATO have yet to release guidance regarding these points and the implications for our clients.

At this early stage we recommend clients;

- Collate details of their employees, who were not previously eligible at 1st March 2020, for eligibility as at 1st July 2020;

- Collate employees hours of work in the four weeks prior to 1st March 2020 and 1st July 2020;

- In mid to late September 2020 we encourage clients have their books up to date. It maybe a tight turnaround between determining eligibility, enrolment and paying employees, as the first JobKeeper fortnight under JobKeeper 2.0 starts 28th September 2020.

A very useful infographic, which we would recommend reviewing, of the extended JobKeeper program can be found on the Chartered Accountants website here.

If we can assist with the above or any other matters, please do not consider to contact us at admin@nulli2advisory.com.au or 08 8132 6400.