7 April 2020

The Government has announced several changes to Superannuation in responses the economic impacts of Coronavirus.

Early access to superannuation

While superannuation helps people save for retirement, due to the unprecedented economic impact of Coronavirus, accessing superannuation today may outweigh the benefits of maintaining those savings until retirement.

As such the Government is allowing individuals affected by the Coronavirus to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21.

People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

Eligibility

To apply for early release, you must satisfy one or more of the following requirements:

-

You are unemployed.

-

You are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance.

-

On or after 1 January 2020, either

-

-

you were made redundant

-

your working hours were reduced by 20% or more

-

if you are a sole trader, your business was suspended or there was a reduction in your turnover of 20% or more.

-

How to apply

The ATO will have sole responsibility for administering payments from super under the new coronavirus condition of release. You do not need to contact your superannuation fund directly.

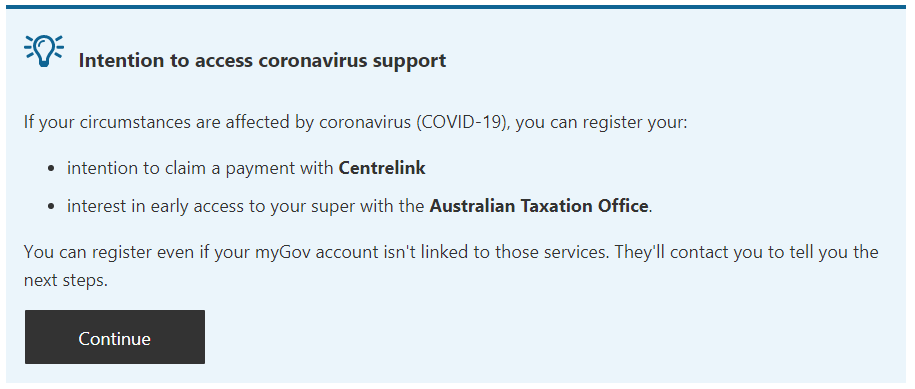

MyGov will be the primary and recommended platform to register your intent to access. Simply log in and click the register your intention to access via the Coronavirus support banner on the MyGov homepage. If

you do not have MyGov you will need to contact the ATO directly or register with MyGov.

Once your interest has been registered, the ATO will contact you directly when the application form is available, which is expected to be mid-April.

You will need to provide bank details and amount requested for withdrawal, which will be provided to your superannuation fund along with the release determination. There is no need to contact your

superannuation fund directly.

The maximum allowed to be released prior to 30/06/2020 is $10,000. You can elect which superannuation fund the funds will be released from. The payment can come from multiple funds, as long as the total amount does not exceed $10,000 each financial year.

Applications can be made up to 30 June 2020 for this financial year and from 1 July 2020 until 24 September 2020 for the next financial year.

If you have a SMSF and wish to access the early release of superannuation you will still need to apply to the ATO. You can’t release any funds until you have received a determination from the ATO.

Any unused early access funds can be recontributed back in the superannuation in the future, subject to normal contribution caps.

If you have insurance in your superannuation, care should taken to ensure your balance is sufficient to pay premiums.

Temporary reduction in minimum pension

For many retirees, the significant losses in financial markets as a result of the COVID-19 crisis are having a negative effect on the account balance of their superannuation pension or annuity.

To assist retirees, the Government has reduced the minimum annual payment required for account-based pensions (including TRIS) and market-linked pensions by 50% in the 2019–20 and the 2020–21

financial years. This will apply to account-based pensions (including TRIS) and market-linked pensions within a SMSF.

The temporary reduction is intended to reduce assets required to be sold at lower prices to fund pension payments.

This relief does not apply to defined benefit pensions or lifetime pensions.

Superannuation providers calculate the minimum annual payment required at 1 July each year, based on the account balance. The 50% reduction will apply to the calculated minimum annual payment.

Pensions commenced after the announcement will still eligible for the reduction.

The revised rates for the 2019/20 and 2020/21 years will be as follows:

| Age of Member |

Original Pension Factor |

Revised Pension Factor |

| Under 65 | 4% | 2% |

| 65-74 | 5% | 2.5% |

| 75-79 | 6% | 3% |

| 80-84 | 7% | 3.5% |

| 85-89 | 9% | 4.5% |

| 90-94 | 11% | 5.5% |

| 95+ | 14% | 7% |

If you have a SMSF administered by us, we will be making contact shortly advising your new minimum pension.

If you wish to only pay the minimum pension you may need contact your superannuation provider to reduce or stop pension payments.

You may also elect that payments above the minimum pension amounts be treated as a lump sum payment.

Lump sum withdrawals may provide future benefit by crediting your transfer balance pension cap ($1.6m), which will allow future superannuation benefits to be moved into retirement pension (tax free) phase.

If you wish to obtain specific advice on the pension changes please contact your usual contact at i2.

Alternatively, if you wish to obtain specific advice on the pension changes and your investments in light of the market downturn, you should contact your financial adviser.

If you do not have an adviser, please note that i2 Wealth has two in-house fully licenced financial advisers who would be happy to assist if you wish. These advisors (Craig Muchamore and Don Sampson) are experienced and empathetic advisers who can discuss, review and guide you through your investment and portfolio management strategy. Please contact your usual contact at i2, who can put you in touch with the advisors.

Other things to note regarding superannuation

-

SMSF with rental properties may consider providing rent relief to their tenants, including related party tenants if it’s commercial viable to do so. Please note any arrangements still have to be on an

arms-length basis.

-

SMSF trustees should be reviewing their investment strategies to ensure, their current investment mix and objectives reflect their current position given the current market volatility.

-

Quarterly and annual transfer balance account reporting (TBAR) has not been delayed. Reportable events still need to be reported to the ATO prior to the deadline.