29 September 2020

The first round of the JobKeeper subsidy ended on 27 September 2020. For those that have been eligible to receive it, it has been a welcome boost to help businesses through what has been an uncertain time.

However – where to now?

With the extension of the JobKeeper rules passed into legislation (colloquially dubbed “JobKeeper 2.0”), businesses need to consider their eligibility under these new rules. This includes businesses who were previously ineligible that may now be eligible, as well as those businesses who have been receiving JobKeeper payments to date.

JobKeeper 2.0 vs JobKeeper 1.0

What remains the same?

- Access for businesses, not for profits, eligible business participants and religious institutions/practitioners

- Decline in turnover percentage thresholds (i.e. 15%, 30% or 50%)

- The need to satisfy wage condition rules

- Monthly reporting of turnover to the ATO

- Integrity rules

- The meaning of eligible employee and eligible business participant

- The rule preventing more than one employer claiming in respect of the same employee

- The enrolment process

What changes?

- The test periods and method of calculation

- Modifications to the ‘Decline in Turnover Test’

- Tiered rates of payments

- 28 September 2020 to 3 January 2021 (Extension 1)

- Tier 1 = $1,200 per fortnight

- Tier 2 = $750 per fortnight

- 4 January 2021 to 28 March 2021 (Extension 2)

- Tier 1 = $1,000 per fortnight

- Tier 2 = $650 per fortnight

- ‘Tier 1’ applies to eligible employees who worked 80 or more hours in the 4 weeks of the pay periods before 1 March 2020 or 1 July 2020 OR eligible business participants who worked 80 or more hours in the 4 weeks of the pay periods before 1 March 2020

- ‘Tier 2’ applies to all other eligible employees and eligible business participants

- 28 September 2020 to 3 January 2021 (Extension 1)

What do I need to do?

- Assess eligibility – are you still (or now) eligible? You will need to enrol if you are eligible.

- Does your business meet the relevant decline in turnover test for the September Quarter?

- Determine eligible employees and the payment ‘Tier level’ they are eligible for based on their reference period

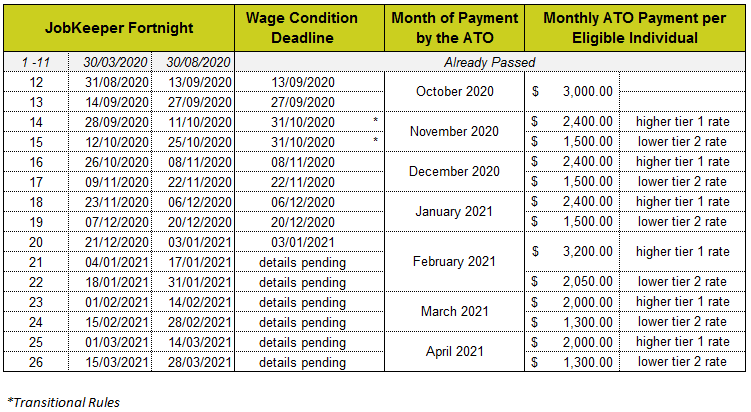

- You have until 31 October 2020 to meet the wage condition (i.e. top-up employees if required) for fortnights ending in October for eligible employees – see Fig 1

- If eligible, you will need to ensure the monthly declarations are lodged with the ATO before the 14th day after the end of each month to receive your payment

What do I need to do in my payroll software?

- Identify the eligible employees and enrol them as JobKeeper participants (only if new to the JobKeeper scheme)

- Assign a Tier 1 or Tier 2 payment rate to each eligible employee

- For more guidance click your accounting software link below

- For those businesses no longer eligible for JobKeeper payments or for individual employees which may no longer be eligible under the JobKeeper extension, you will need to process this in your relevant software by ‘stopping’ JobKeeper payments

- Without doing the above as it applies, Single Touch Payroll filing may be rejected

Fig 1 – JobKeeper Fortnight Calendar

We are happy to assist with any of the above from assessing your eligibility as an employer and identifying the eligible employees and/or business participants that you can receive payments for.

If we can assist with the above or any other matters, please do not hesitate to contact us at admin@nulli2advisory.com.au or 08 8132 6400.

DISCLAIMER: This summary is for general use only and should not be relied upon or taken to constitute advice. Further, it is based on available information which is subject to change.