28 November 2017

Historically, taxpayers may have been able to claim a deduction for the costs associated with setting up a business or raising finance, including the costs incurred in:

- establishing a company or other business structure

- converting a business structure to a different structure

- raising equity for the business

- defending it against a takeover

- unsuccessfully attempting a takeover

- stopping carrying on business (including liquidating a company).

For these capital expenses, you have generally been able to claim a deduction over a five-year period on a straight line basis (that is 20% in the year you incur them and in each of the following four years). To have availed yourself of this deduction, the relevant costs must not be deductible under any other part of the tax law nor form part of the cost of a capital gains tax or depreciating asset.

Before July 1, 2015, relevant business capital expenditure, including start-up expenses, was deductible under the auspices of this five year deduction entitlement housed under a section of the capital allowances rules. However after that date, certain start-up expenses for businesses, including costs associated with raising capital, that would otherwise have been deductible over five years, can be immediately deductible. These include professional expenses associated with starting a new business, such as professional, legal and accounting advice.

Requirements for deduction

Specifically, under these rules, expenditure that would be deductible over five years is fully deductible in the income year in which the expenditure is incurred if the expenditure:

- relates to a business that is proposed to be carried on, and

- is either:

- incurred in obtaining advice or services relating to the proposed structure or the proposed operation of the business (see below), or

- is a payment to an Australian government agency of a fee, tax or charge incurred in relation to setting up the business or establishing its operating structure (see below), and

- the entity that incurred the expenditure is either:

- a small business entity (SBE) for that income year, or

- does not carry on a business and does not control and is not controlled by an entity carrying on a business in the relevant income year that is not an SBE in that income year.

Types of start-up costs for which an immediate deduction is allowed

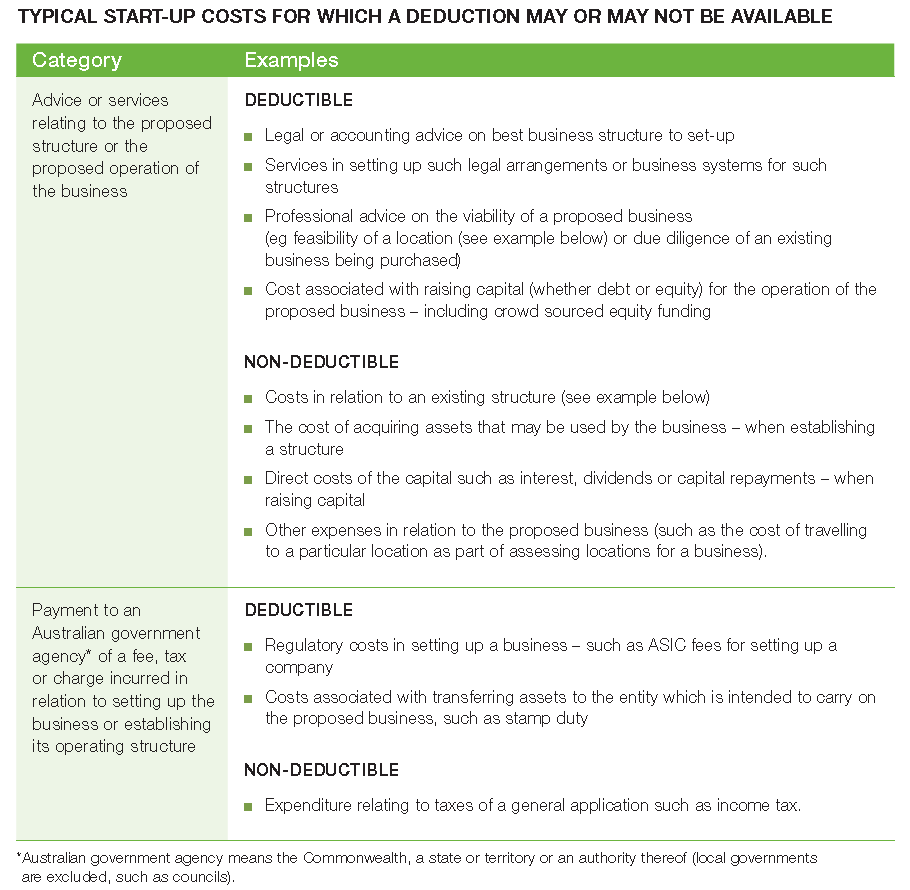

The typical start-up costs for which a deduction would be available are as follows:

Example 1: Start-up expenses that can be immediately deducted

Winston Co is a company that is an SBE and is in the process of setting up a florist business, to be operated by a separate entity. Winston Co is uncertain as to the best location for the proposed business. Winston Co obtains advice from a consultant in order to assist in determining a suitable location. The cost of obtaining this advice is to be fully deducted in the income year in which it is incurred.

Example 2: capital expenditure that cannot be immediately deducted

Percy already carries on an established small landscaping business. As part of plans to expand and improve his business Percy obtains financial advice about financing the expansion. As Percy’s business is already established, a deduction cannot be immediately claimed for the costs incurred.