18 August 2020

It was much quicker than we anticipated, but the ATO have now released guidance on changes to the current JobKeeper program relating to ‘employee eligible dates’ which needs urgent consideration from employers.

From the 3rd of August, the reference date for an employee’s eligibility to JobKeeper payments changes from 1st of March to 1st of July 2020. Employers now need to consider the eligibility of employees who were employed at 1st July 2020.

There is no change for existing employees who were already eligible for the JobKeeper program, nor is there any change to an employer’s existing eligibility to the JobKeeper program.

Which employees may now be eligible?

For the JobKeeper fortnight beginning 3rd August 2020, there are a number of employees who may now be eligible as at the 1st July 2020 including;

- New staff who started after 1st March 2020

- Casuals who have, since 1st March 2020, met the definition of long term casual employees

- Employees who were not eligible due to their age

- Employees who may hold an eligible visa

Other circumstances to review and consider

- Employees who may have nominated for JobKeeper with another employer, under limited circumstances can re-nominate with a new employer as long as they have ceased their employment with the original employer between 1st March 2020 and 1st July 2020

- An employer who was previously ineligible for JobKeeper, still has the ability to test their JobKeeper eligibility in the months of August and September. Eligible employees may include employees who started prior to 1st July 2020

Action Items

- Review your existing employees and business participants who were not previously eligible for JobKeeper to determine if they are now eligible

- Provide those employees with an employee nomination form ASAP. The ATO has updated this form and you can find it here

- Calculate any shortfalls required for employees whose pay is required to be ‘topped up’ to $1,500 per fortnight. Note: the full time and part-time rates only apply for JobKeeper 2.0 which begins 28th September 2020

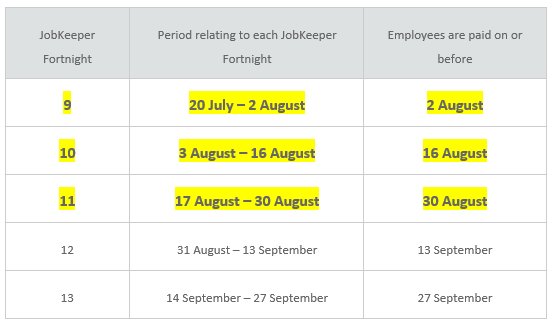

- Payment of any top up is required by 31st August 2020 in respect of the JobKeeper fortnights 3rd August – 16th August 2020 and 17th August – 30th August 2020

‘One in – All in’ principle still applies

- Remember the ‘One in – All in’ principle continues to apply

- If you are already a participant in JobKeeper you need to provide employee nomination forms to those employees who may now be eligible

- You do not have discretion to exclude employees

If we can assist with the above or any other matters, please do not hesitate to contact us at admin@nulli2advisory.com.au or 08 8132 6400.